Web3 Credit Card Explained: Everything You Need to Know

October 25, 2024

As blockchain technologies continue to evolve, so too do the financial products built on top of them. One such innovation is the Web3 credit card—a concept that merges the traditional structure of credit cards with the decentralized nature of Web3. This guide aims to provide a clear, educational overview of what a Web3 credit card is, how it works, and what implications it may have for users and the broader financial system.

What Is a Web3 Credit Card?

At its core, a Web3 credit card is a financial tool that allows individuals to spend cryptocurrencies or engage with decentralized financial services using a credit card interface. While it often resembles a traditional Visa or Mastercard in appearance and function, what sets it apart is its integration with blockchain-based platforms and crypto wallets.

Rather than relying solely on fiat currencies, these cards can connect directly to users’ crypto holdings—whether in a custodial exchange wallet or a non-custodial option like MetaMask. The transactions may be settled in fiat, but the source of funds, rewards, and even benefits are tied to digital assets.

How Does It Work?

To understand how a Web3 credit card works, consider it as a bridge between Web3 (decentralized finance) and Web2 (traditional finance). Here’s a simplified overview:

- Application Process

Users sign up through a provider such as Coinbase, Crypto.com, Nexo, or Hi. These platforms may require identity verification and crypto wallet linkage. - Crypto-Fiat Conversion

When a purchase is made, the provider either instantly converts crypto to fiat or offers a credit line backed by the user’s crypto holdings. - Transaction Settlement

On the merchant’s side, transactions are processed in local currency, just like with any standard card. The crypto mechanism happens in the background. - Rewards and Benefits

Instead of traditional reward points or airline miles, users earn crypto cashback or token-based incentives—often in stablecoins like USDC or platform tokens like CRO. - Optional Features

Some cards provide additional perks such as staking bonuses, DeFi access, or NFT-based personalization.

Key Benefits

Crypto Rewards

Instead of points with limited use cases, these cards return value in crypto, which may appreciate or be reinvested.

Direct Blockchain Access

Some Web3 credit cards integrate directly with DeFi protocols, enabling users to participate in staking, lending, or liquidity pools.

Global Usability

Crypto can be used for real-world purchases across borders without the friction of currency conversion—particularly useful for digital nomads.

Banking Optional

For users seeking more control over their finances, some Web3 cards function without traditional bank intermediaries.

Potential Challenges and Risks

Despite the innovation, Web3 credit cards are not without drawbacks.

Price Volatility

Using volatile cryptocurrencies (like ETH or BTC) for daily purchases means the effective cost of an item can fluctuate dramatically.

Tax Implications

In many jurisdictions, every crypto transaction is a taxable event, including small purchases—something users must account for.

Regulatory Uncertainty

Regulations around crypto cards vary widely by country. Some services may be geofenced or have usage limitations.

Limited Mainstream Adoption

While the technology is progressing, Web3 cards remain a niche product—primarily used by those already familiar with crypto ecosystems.

Examples of Web3 Credit Cards in the Market

Several companies have launched or are piloting Web3 credit card models:

- Coinbase Card: Offers crypto rewards and direct integration with Coinbase wallets.

- Crypto.com Visa: Popular for its tiered benefits, including cashback and subscription rebates based on CRO staking.

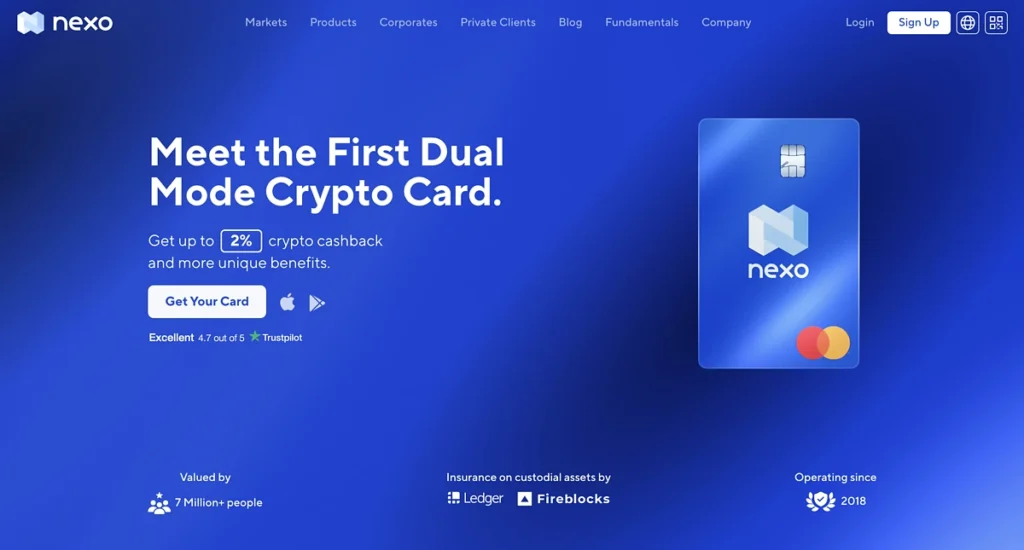

- Nexo Card: Unique in that it allows users to spend without selling their crypto, using it as collateral.

- Hi Card: Incorporates NFT avatars and personal branding into the Web3 card experience.

Each platform brings its own features and limitations, so it’s important to compare offers based on your location, crypto preferences, and spending habits.

Conclusion: Web3 Credit Card Explained for the New Financial Era

The concept of a Web3 credit card represents an important step in merging traditional finance with blockchain innovation. For users who are already engaged in the crypto space, these cards offer a new way to unlock value without constantly converting assets back into fiat.

While not yet a mainstream product, the rise of Web3 credit cards signals a shift toward greater financial autonomy and flexibility. As regulations mature and user experience improves, adoption is likely to grow. Whether you’re exploring crypto for the first time or you’re a seasoned blockchain enthusiast, understanding how these cards work can help you navigate this next phase of digital finance with confidence.

Relevant News : Here