Vietnam Crypto Law 2025: What Legalization Means for Traders and Businesses

March 1, 2025

As of 2025, Vietnam has officially legalized the use of cryptocurrencies and other digital assets under its comprehensive Vietnam crypto law. The introduction of clear VDA rules and a government-backed licensing system has transformed a once uncertain legal landscape into a structured, regulated environment.

If you’re wondering how this impacts trading, ownership, and compliance in Vietnam, this FAQ-style column breaks down the essentials in plain terms — no legal jargon, just straight answers.

1. Is Crypto Legal in Vietnam Now?

Yes. As of early 2025, crypto trading and ownership are fully legal in Vietnam under the new Vietnam crypto law. Individuals and businesses can hold, transfer, and trade cryptocurrencies, provided they follow official VDA rules and use licensed platforms. This legalization marks a pivotal shift from earlier years when crypto existed in a legal gray area. The law now offers clear protections for consumers and obligations for service providers. Vietnamese citizens are free to use crypto for investment purposes, though it is still not recognized as a form of legal tender for payments.

2. What Are VDAs, and Why Do They Matter?

Credit from Observer Voice

VDA stands for Virtual Digital Asset. Under Vietnam’s updated regulatory framework, this umbrella term includes cryptocurrencies (like Bitcoin and Ethereum), security tokens, and utility tokens. The law distinguishes between different types of VDAs based on their function — whether they’re used as investments, mediums of exchange, or access rights to platforms or services. These classifications influence the kind of regulatory obligations that apply, such as disclosure, capital requirements, and ongoing audits. This structure helps prevent misuse while also encouraging responsible innovation and investment.

3. Do I Need a License to Trade Crypto in Vietnam?

If you’re an individual investor trading for personal purposes, you don’t need a license — but you must use a licensed exchange that meets national compliance standards. However, if you operate a business, brokerage, or digital asset platform, then securing a VDA license is required. These licenses are issued by the Ministry of Finance, and the process includes a thorough review of financial stability, cybersecurity readiness, anti-money laundering controls, and transparency practices. Operating without a license may result in penalties, including suspension or legal action.

4. Can Foreign Crypto Companies Operate in Vietnam?

Credit from Lexology

Yes, foreign companies are permitted to enter the Vietnamese market, but they must adhere to local requirements. A foreign crypto firm must establish a legal presence in Vietnam, maintain a Vietnamese-speaking support team, and comply with local consumer protection laws. These conditions are part of Vietnam’s effort to ensure overseas companies remain accountable to local users. The Vietnam VDA rules require foreign firms to undergo the same licensing process as domestic entities. While the entry barrier is higher, it ensures a more secure and transparent marketplace for Vietnamese users.

5. Are There Taxes on Crypto Gains in Vietnam in Vietnam Crypto Law 2025?

Yes. Under current tax policy, digital assets are considered taxable income. This applies to both capital gains from trading and income earned through mining or staking activities. For individuals, profits are filed under personal income tax, with tiered rates depending on annual earnings. For businesses involved in crypto, corporate tax applies based on net income. The General Department of Taxation has begun working with exchanges to improve reporting, and it’s expected that annual declarations will soon require specific breakdowns of digital asset holdings and earnings. Failing to report accurately may result in penalties.

6. What About NFTs and Other Digital Assets?

Credit from ForumIAS

NFTs are included under the broader category of VDAs, but how they’re treated depends largely on their use case. NFTs linked to investment schemes, royalties, or tokenized securities must follow financial compliance rules. However, one-of-a-kind digital art, collectibles, or non-commercial NFTs may remain outside the licensing scope — at least for now. Regulators are still debating how to handle the evolving NFT space, particularly regarding intellectual property rights and fraud prevention. Businesses dealing in NFTs are advised to consult legal counsel to determine their classification under Vietnamese law.

7. How Does Vietnam’s Crypto Law 2025 Compare Globally?

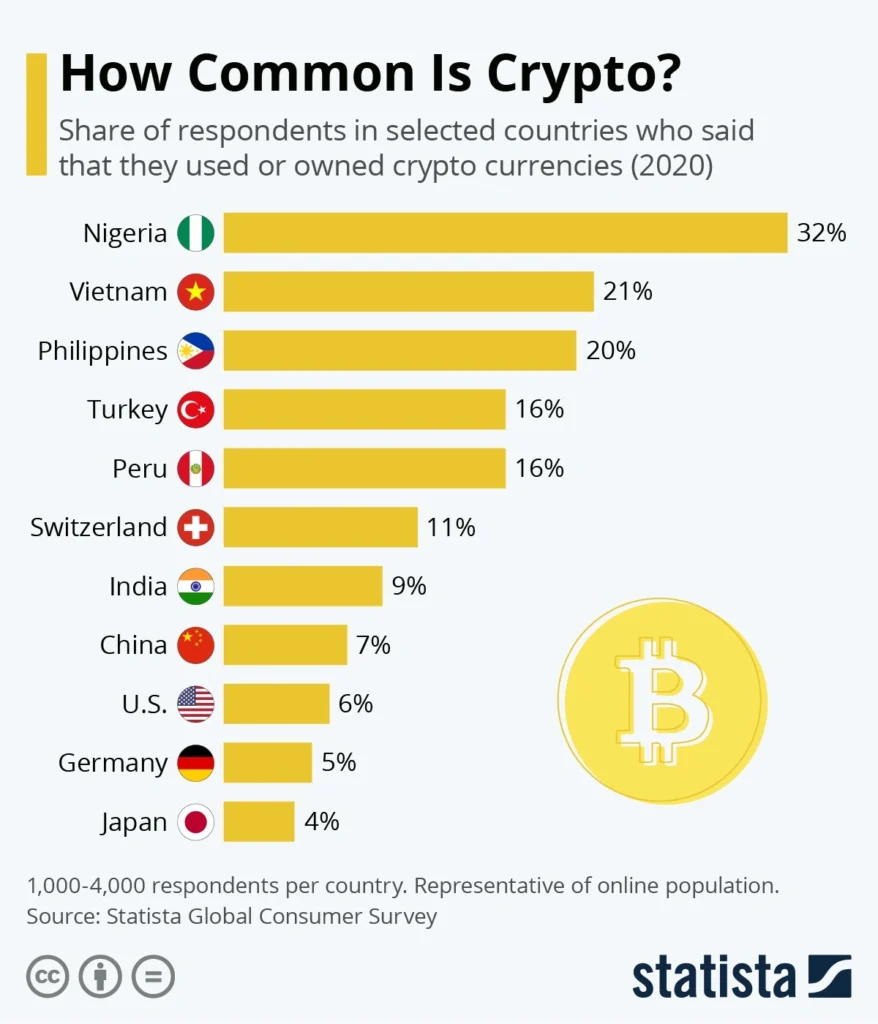

Vietnam’s 2025 crypto law is viewed as both progressive and pragmatic. It legalizes digital asset activity while building a regulatory framework to minimize financial crime and protect investors. Unlike countries that have imposed outright bans or overly lax policies, Vietnam aims to find middle ground. Its VDA rules draw inspiration from regulatory models in Singapore, Japan, and parts of the EU, but are tailored to local needs and economic goals. Observers see this as a model for other Southeast Asian nations considering formal crypto legislation.

Conclusion: Vietnam Crypto Law 2025 Sets the Stage for a Regulated Future

By legalizing digital assets and introducing structured Vietnam VDA rules, the government has created a more predictable and secure crypto environment. For years, investors operated without a clear legal foundation — now, they have one. This transition enables safer trading, better consumer protection, and a more mature financial ecosystem.

Vietnam’s approach balances innovation with accountability, allowing the market to grow while keeping bad actors in check. Whether you’re a retail investor, tech entrepreneur, or foreign exchange operator, the 2025 law defines the path forward — one built on transparency, compliance, and opportunity.