Understanding Trading Psychology Indonesia: A Guide for Beginner Traders

July 16, 2025

Trading psychology Indonesia refers to the emotional and mental aspects that influence decision-making in financial markets. For beginner traders in Indonesia, this is often the most underestimated factor. While technical skills and market analysis are important, your ability to stay calm, rational, and disciplined under pressure often has a greater impact on long-term success. Emotions such as fear, greed, and regret can cloud judgment and push traders into poor decisions—sometimes even wiping out a well-planned strategy. In other words, even the best tools are useless without the right mindset behind them.

Trading psychology Indonesia: How Does Discipline Affect a Trader’s Performance?

Discipline is the invisible structure that holds a trader’s approach together. It means committing to your trading plan even when emotions are running high. Many beginner traders in Indonesia create trading plans—defining when to enter, how much to risk, and when to exit—but then abandon them the moment a trade moves against them or shows quick profits. Without discipline, small losses become large ones, and small wins are exited too soon. Setting stop-loss and take-profit levels in advance is one way to keep yourself from making emotionally driven decisions. Discipline doesn’t guarantee a win every time, but it protects you from the worst of your own impulses.

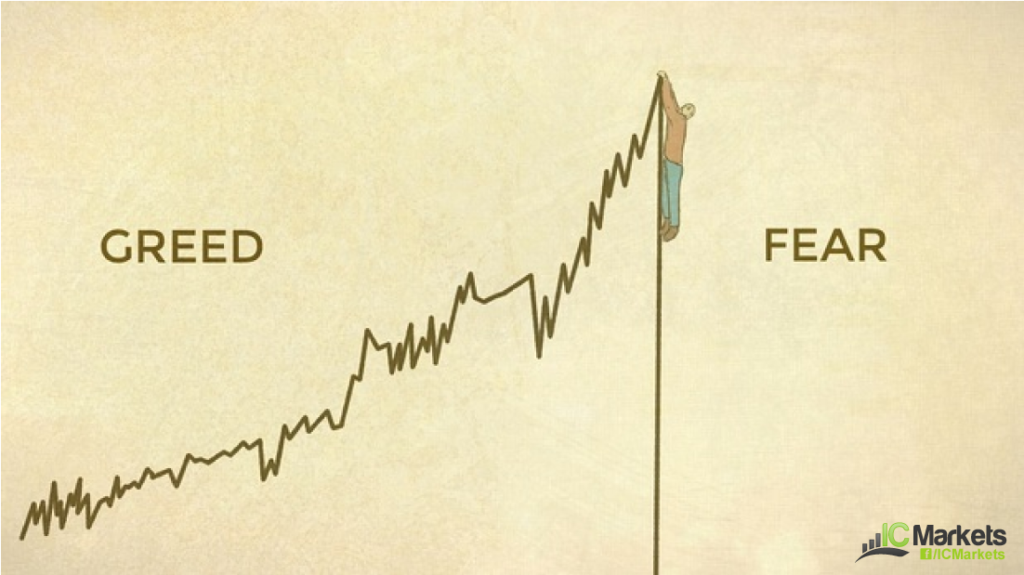

Trading psychology Indonesia: Why Are Fear and Greed So Powerful in Trading?

Source: ICMarketsGlobal

Fear and greed are emotional forces that show up constantly in the market. Fear often arises after a loss or during volatile news events, making traders hesitant or even paralyzed. On the other hand, greed tends to take over when prices rise sharply or after a series of wins, pushing traders to take on more risk than they should. For Indonesian traders, the fast-paced nature of local forex and crypto markets can intensify both feelings. Managing these emotions means recognizing them early and sticking to your plan regardless of external noise. Emotional awareness allows traders to act with clarity rather than reaction.

Trading psychology Indonesia: What Psychological Traps Do Beginner Traders Often Fall Into?

Source: Pinterest

Beginner traders frequently encounter a few common psychological traps, often without realizing it. One of the most widespread is FOMO—the fear of missing out. It appears when traders see rapid gains and feel pressured to jump in without doing their own analysis. The result is usually late entries into already-exhausted trends. Another major pitfall is revenge trading, where a trader reacts to a loss by taking impulsive trades in an attempt to “get back” what was lost. This rarely ends well.

Overtrading is another subtle trap, where the trader executes too many trades without clear strategy, driven more by the need to act than by market signals. Then there’s the gambler’s fallacy: believing that a string of losses will eventually be “balanced out” by a win—leading to increasingly risky decisions. Finally, herd mentality causes traders to follow others blindly, trusting market sentiment more than their own research. Each of these behaviors undermines objective trading and reinforces bad habits.

How Can Beginners Improve Their Trading Psychology?

Source: medium

Improving trading psychology Indonesia involves a combination of structure, self-reflection, and consistency. One of the most effective ways to start is by building a clear trading plan that outlines your entry and exit points, risk level per trade, and profit targets. This becomes your compass during uncertain moments. Another helpful practice is keeping a trading journal—not just to track wins and losses, but also to record your emotional state and the reasoning behind each trade. Over time, this helps identify emotional patterns that lead to mistakes.

Stop-loss and take-profit orders are not just technical tools—they’re psychological tools. They help enforce discipline by removing real-time decision-making under emotional stress. After big wins or losses, it’s wise to take a short break. Emotional highs and lows can distort judgment, so stepping away gives your mind space to reset. Lastly, commit to continuous learning. The markets change, and so should your mindset. Reflecting on past trades, studying market behavior, and adjusting your strategy are key steps in personal and trading growth.

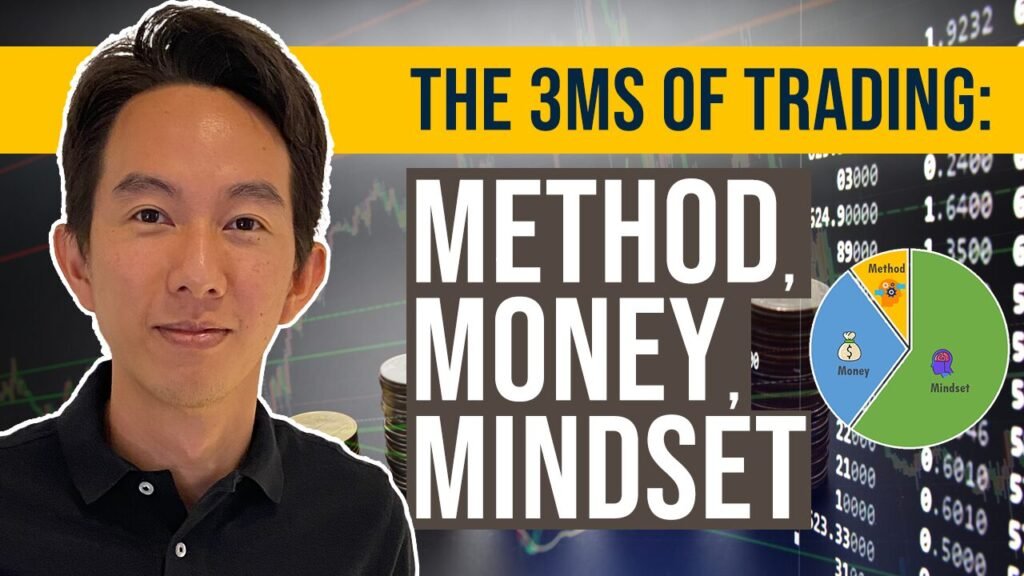

What Is the 3M Framework and Why Is It Useful?

Source: synapsetrading

A popular approach in trading psychology is the 3M framework: Mind, Method, and Money. “Mind” represents your psychological state—how well you control your emotions, stay focused, and manage stress. “Method” is your trading system or strategy, which should be consistent, testable, and suited to your personality. “Money” refers to how you manage capital, including position sizing and risk exposure.

Balancing these three aspects is essential. Even with a strong strategy and good money management, emotional instability can ruin a trader. Likewise, a calm mind is not enough without a sound strategy and risk controls. The strength of the 3M framework lies in its holistic approach, showing that psychological readiness is not separate from trading technique—it’s intertwined.

What Causes Emotional Trading and How Can It Be Prevented?

Source: Stock Cake

Emotional trading usually happens when a trader reacts to the market based on feelings rather than facts. This might come from fear of losing out, frustration after a losing streak, or overconfidence from recent gains. In fast-moving markets, these emotions can build up quickly. For beginner traders in Indonesia, emotional trading can be especially dangerous as it creates a cycle of impulsive actions and erratic outcomes.

Preventing emotional trading starts with having a plan—and trusting it. Before entering a trade, make sure your conditions are met. If they aren’t, don’t force it. Limit your exposure to social media during trading hours, as market chatter can amplify emotional responses. It’s also helpful to take regular breaks and even schedule non-trading days to regain emotional clarity. Emotional control doesn’t mean never feeling anything—it means knowing how to act despite what you feel.

Is Intuition Reliable for Traders?

Intuition in trading can be a double-edged sword. For experienced traders, it often reflects subconscious pattern recognition built through years of practice. But for beginners, what feels like intuition may actually be bias, impatience, or hope. While it’s tempting to “follow your gut,” doing so without experience or data can be risky.

That said, intuition doesn’t need to be ignored completely. It can serve as an internal signal to pause and recheck your analysis. If your gut tells you something is off—stop, review, and make sure your decision is still grounded in logic. Over time, as you gain more experience, your intuitive sense will become sharper and more reliable. Until then, let data and structure lead, and use intuition as a secondary layer of insight, not the foundation of your decision.

Conclusion: Why Trading Psychology Indonesia Matters for Long-Term Success

In trading, your biggest challenge is not the market—it’s yourself. Many beginner traders in Indonesia spend time perfecting their strategies but overlook the importance of mental preparation. Trading psychology Indonesia teaches us that without emotional control, even the best strategies will fail under pressure.

Success in trading is less about being right all the time and more about staying consistent, managing risk, and maintaining composure in the face of uncertainty. This requires discipline, self-awareness, and a willingness to learn from mistakes. In the end, the traders who succeed are not just those who understand the market—but those who understand themselves.