The Ultimate Guide to Building a Trading Journal Indonesia (With Templates)

April 20, 2025

Trading Journal Indonesia: In the fast-paced world of trading, a trading journal Indonesia has become an essential tool for both beginners and seasoned investors. More than just a notebook or spreadsheet, it’s a living record of decisions, emotions, market conditions, and outcomes. Whether you’re trading forex, crypto, or stocks, journaling brings accountability and clarity. A trading journal helps you see the patterns — both good and bad. It captures what worked, what didn’t, and perhaps most importantly, why. This reflective process builds discipline and provides insights that no chart alone can offer.

How to Build a Trading Journal with Templates

There’s no one-size-fits-all method, but learning how to build a trading journal with templates starts with a clear structure. Choose a format that fits your trading style — digital spreadsheets like Excel or Google Sheets, physical notebooks, or dedicated journaling apps. From there, follow a step-by-step process: choose your preferred format, identify the key data you want to track, record every trade as soon as possible, review periodically, and adjust strategies accordingly. Templates simplify this process, offering a ready-made structure for tracking important metrics without having to build your journal from scratch.

What Should Be in a Trading Journal?

A complete trading journal template for beginners includes both numerical data and contextual information. Numbers tell you what happened, but the context explains why it happened. Some of the most important fields include the trade date and time, the instrument traded, trade direction (long or short), entry and exit prices, position size, stop-loss and take-profit levels, the strategy used, market conditions, emotional state, the result of the trade, and post-trade reflections. These components give a complete picture of each trade and help traders spot behavioral or strategic patterns over time.

The Best Way to Create a Trading Journal (Step-by-Step)

Source: mtrading

For those looking for the best way to create a trading journal, it comes down to consistency and personal fit. First, select a platform that suits you. Google Sheets and Excel are flexible and widely used, while physical notebooks might suit those who prefer handwriting. Second, customize the template based on your trading focus — whether that’s forex, stocks, or crypto. Third, make it a habit to record every trade, immediately after it happens. Fourth, dedicate time weekly or monthly to review your journal. And lastly, allow your trading strategy to evolve based on what your journal reveals. The more disciplined you are in keeping it updated, the more valuable it becomes.

Free Downloadable Trading Journal Templates

Source: FLIPHTML5

If you’re starting out or want a faster setup, several free downloadable trading journal templates are available online. These include the Forex Trading Journal Template, which includes swap tracking and supports multiple currency pairs. The Leak Finder Journal helps assess where your strategy may be failing. The Simple Trade Journal offers a minimal layout for speed and clarity. The Multi-Market Journal supports various asset classes including stocks, crypto, and futures. Emotional Tracker Templates let you assess how your mindset affects your trades. Some more advanced options like the Excel Journal by The Disciplined Trader come with multiple sheets and even video guides. There are also customizable beginner-friendly formats and templates that include performance benchmarks like S&P 500 comparisons. These resources can provide a strong foundation for your own trading records.

Trading Journal Indonesia: Which Format Suits Your Style?

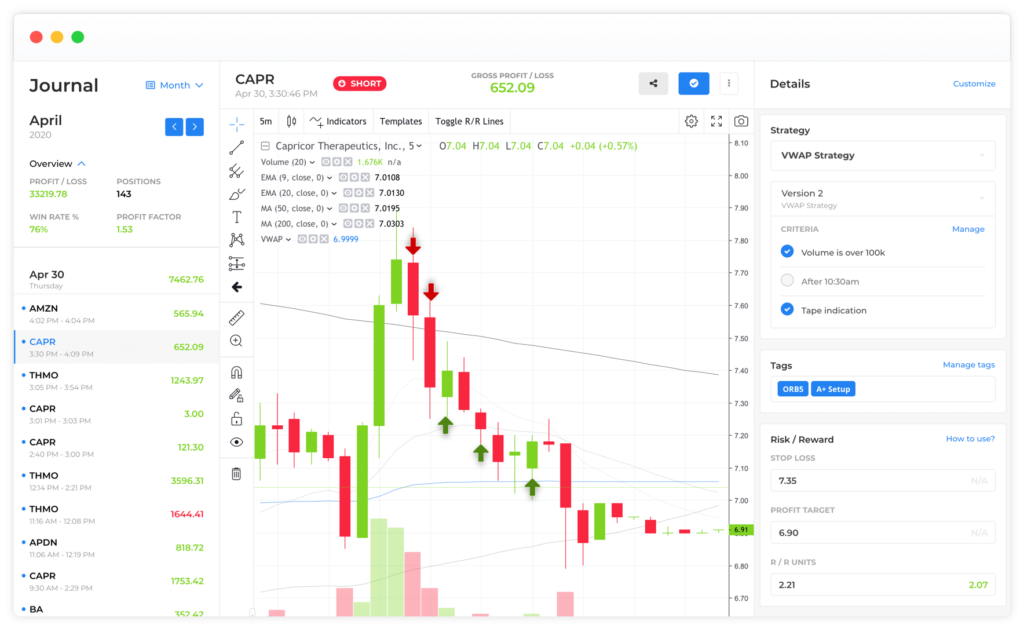

Source: Chartlog

Not every trader uses the same methods, so the trading journal Indonesia you build should reflect your trading habits and preferences. Day traders, for example, benefit from highly detailed, time-sensitive logs with timestamps and multiple trades per day. Swing and position traders, on the other hand, may focus on longer-term patterns, macroeconomic news, or technical setups. If you’re a visual learner, use charts, graphs, or screenshots within your journal. Tools like Notion or spreadsheet plugins can help with visualizations. Manual journalers who prefer writing by hand should consider using pre-printed templates and physically attaching charts or news clippings. Matching your journaling method to your trading style makes the process more sustainable and insightful.

Trading Journal Indonesia: How to Analyze Trading Performance Using a Journal

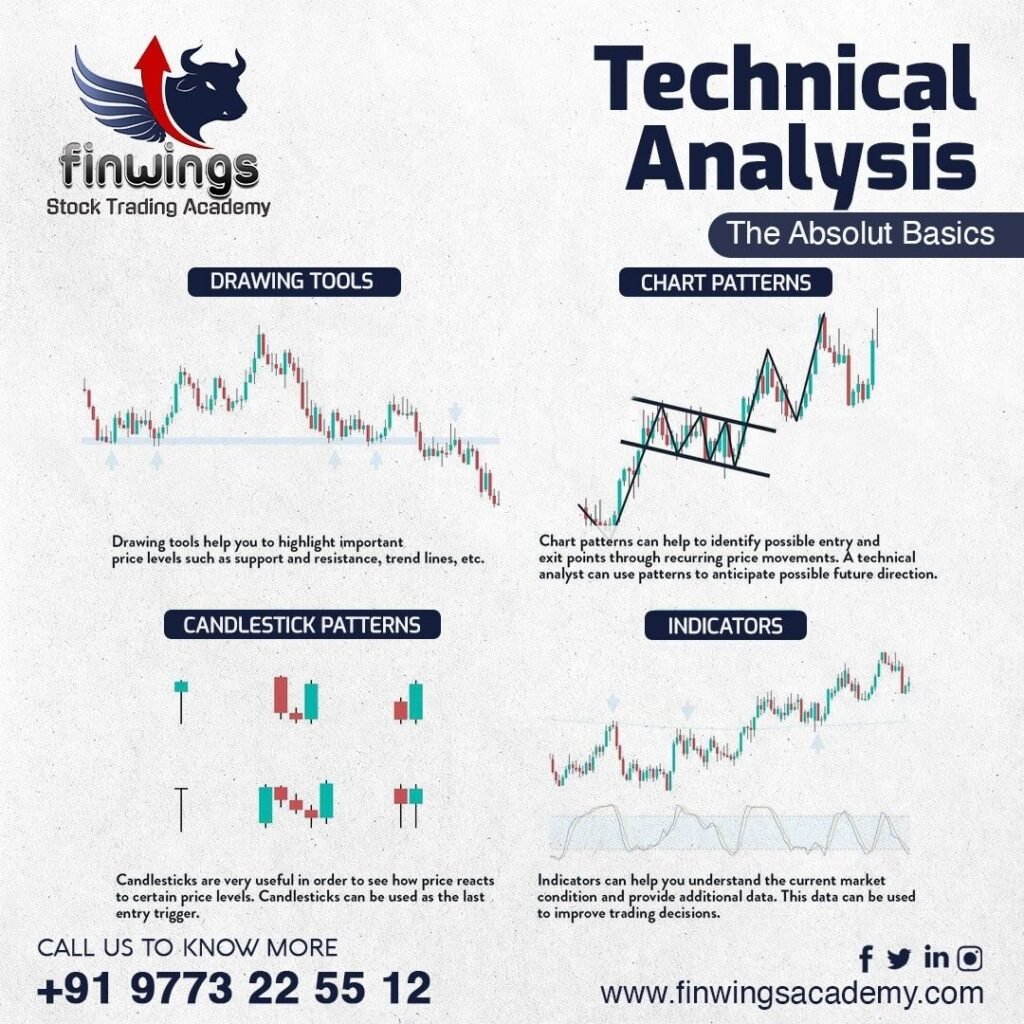

Source: Finwings

At its core, a trading journal is a trading analysis tool, and understanding how to analyze your performance is key. Begin by calculating important metrics like win rate, average return per trade, drawdown, and risk-to-reward ratios. But don’t stop at the numbers. Ask yourself honest questions after each session: Did I stick to my trading plan? Was I emotionally influenced by fear or excitement? Could I have managed risk better? Creating a habit of monthly summaries can reveal long-term trends and highlight improvements or recurring mistakes. Visual tools like pie charts and bar graphs can also bring your data to life, making it easier to understand your trading behavior at a glance.

Special Note for Crypto Traders in Indonesia

For Indonesian traders active in crypto markets, a crypto trading journal requires special consideration. The 24/7 nature of crypto markets means more volatility, more emotion, and more complexity. Your journal should include details like the coin traded, market type (spot, futures, or margin), slippage, transaction fees, and your emotional response during periods of high volatility. Many crypto trades are triggered by fast-moving events like exchange listings or social media hype, so noting your trade rationale is critical. Apps like CoinMarketMan and Pintu offer tools tailored to crypto journaling, making it easier to automate some of the logging process while still maintaining accuracy and consistency.

Tools to Enhance Your Journal: FlipHTML5

If you want to enhance your trading documentation, tools like FlipHTML5 can turn your static spreadsheets or Word documents into interactive digital journals. This platform allows you to convert Excel files into engaging digital flipbooks that can include embedded charts, videos, voice notes, and even branding elements. It’s particularly useful for those who want to create presentation-ready journals or share their logs with a mentor or trading community. FlipHTML5 also offers AI features that can help generate layouts and visuals based on prompts, making it a creative upgrade from standard journal formats.

Final Thoughts: Start Small, Stay Consistent

Building a trading journal Indonesia doesn’t require fancy tools or complex systems — the key is to just start. Begin with a simple format that tracks basic trade information and emotional notes. Over time, as your skills and needs grow, your journal can evolve into a more sophisticated analysis tool. The most important part is consistency. Record every trade, even the bad ones. Review regularly. Adjust your strategies based on your own data, not guesswork. In a market that often feels chaotic, a trading journal provides order — and with that comes clarity, improvement, and long-term growth.