Rupiah Forecast 2025: Can Indonesia’s Currency Withstand Global Volatility?

April 20, 2025

What Is the Rupiah Forecast for 2025?

The Rupiah forecast 2025 presents a complex but increasingly relevant question for anyone monitoring Indonesia’s place in the global financial ecosystem. As of early 2025, the Indonesian Rupiah (IDR) has maintained moderate stability, but volatility remains a lingering risk. The currency’s performance this year will be influenced by a convergence of internal economic reforms, external market shocks, and how policy institutions respond in real time. With global interest rate cycles nearing their peak and several major economies flirting with stagnation, the IDR finds itself in a sensitive position. If Indonesia can sustain investor confidence through steady economic performance and regulatory clarity, the currency may avoid sharp swings. But like many emerging market currencies, it remains vulnerable to turbulence from beyond its borders — particularly shifts in the U.S. dollar, regional geopolitics, and commodity prices.

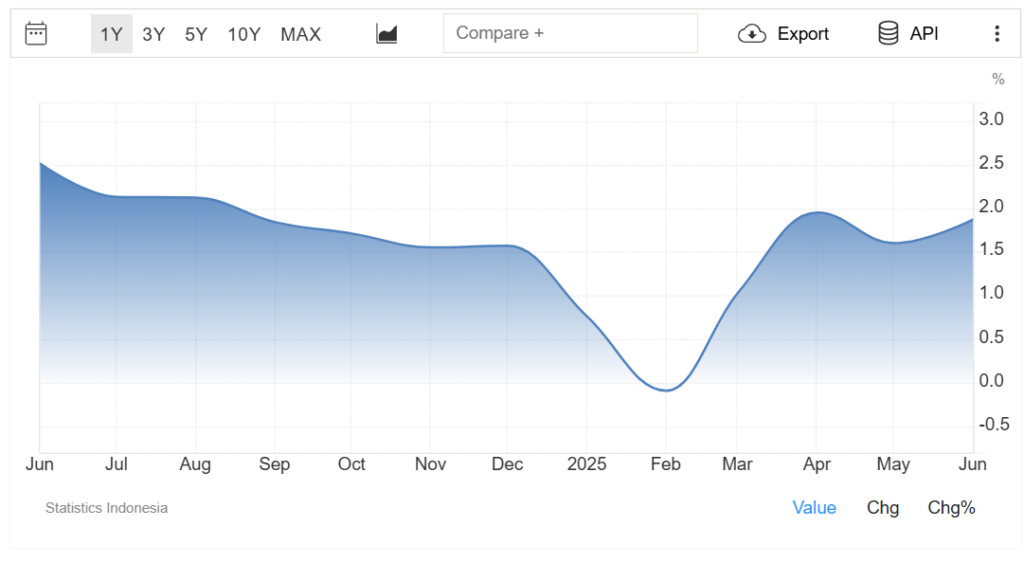

What Could Weaken the Rupiah in 2025?

Source: TradingEconomics

Several risk factors could undermine the Rupiah’s position in 2025, many of which lie beyond Indonesia’s control. Among them, the direction of the IDR/USD forecast 2025 will be deeply affected by U.S. monetary policy. If the Federal Reserve delays interest rate cuts or doubles down on a hawkish stance due to inflationary pressures, capital may flow out of emerging markets and into U.S. assets, leading to a depreciation of the Rupiah. Domestically, concerns around energy subsidies, fiscal consolidation, or a weakening trade surplus could dampen investor sentiment. Additionally, the possibility of political noise from local or regional elections may inject uncertainty into markets, even if temporarily. All of these elements make it clear that the Rupiah’s path won’t be dictated by economics alone — perceptions and confidence will be equally influential.

Will the Rupiah Strengthen Against the USD?

Source: Jakartaglobe

Although risks are real, the Rupiah is not without its strengths, and a moderate appreciation in 2025 is still on the table under the right conditions. A supportive global backdrop — such as easing interest rates from developed markets or a rebound in Asian trade flows — could alleviate external pressure on emerging currencies. For Indonesia, a consistent trade surplus, healthy foreign exchange reserves, and manageable inflation would help the IDR to USD exchange rate find more stability or even gain ground. In addition, if Bank Indonesia continues its coordinated approach to macroprudential measures, including timely interventions in currency markets and open communication with investors, confidence in the IDR may grow. Nonetheless, the scope for meaningful strengthening may be limited, as the U.S. dollar still enjoys global demand in times of financial stress — a reminder that any gains for the Rupiah would need to be earned through policy credibility and economic resilience.

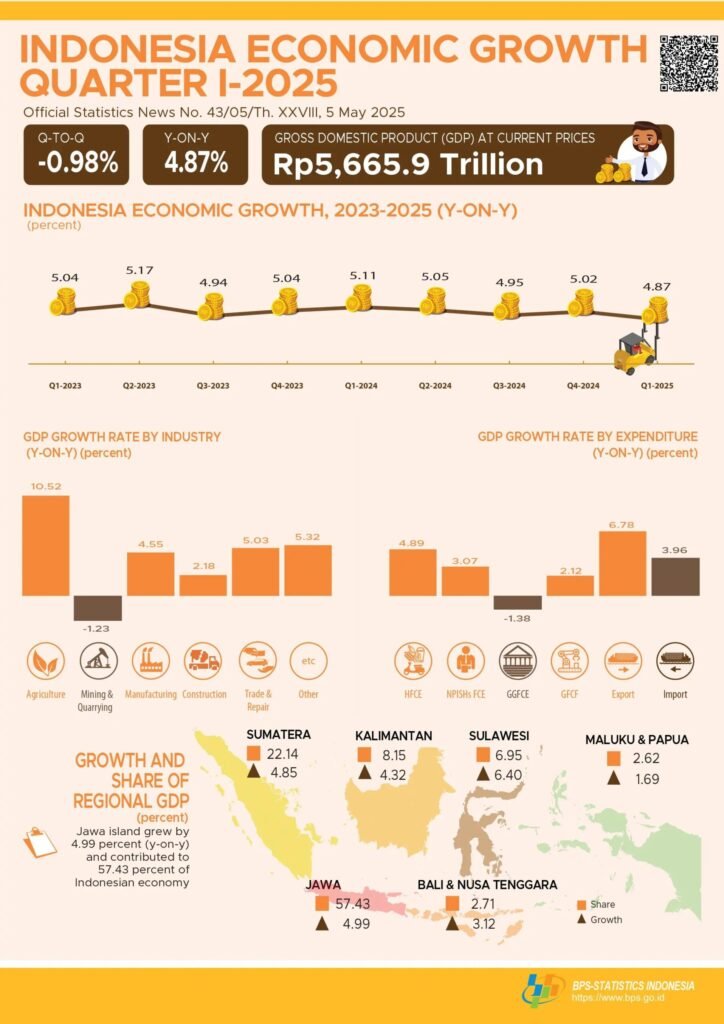

How Does the Indonesian Economy Affect the Forecast?

Source: BPS- Statistic Indonesia

The health of the Indonesia economy is the foundational pillar upon which all Rupiah forecasts are built. Over the past decade, Indonesia has demonstrated relative macroeconomic stability, with steady GDP growth, manageable debt levels, and a young, consumption-driven population. For 2025, the country’s performance will depend on the success of ongoing infrastructure development, digital transformation, and external trade relationships — particularly with key partners such as China, the U.S., and members of ASEAN. A robust domestic economy can buffer the impact of global uncertainty, but it’s not immune to slowdowns abroad. If global demand softens or if commodity exports — a vital component of Indonesia’s trade revenue — face price declines, the country’s external balance could be tested. In short, Indonesia’s own fundamentals may be solid, but the country will still need favorable external conditions to maintain Rupiah stability.

What Role Does Bank Indonesia Play in Currency Stability?

Source: ADCOLAW

The central bank’s influence on the Bank Indonesia currency forecast 2025 cannot be overstated. As the guardian of monetary policy, Bank Indonesia has been careful in its interventions, typically stepping in to prevent excessive volatility rather than force a fixed direction. Heading into 2025, it continues to walk a fine line between managing inflation and supporting growth. With the potential for U.S. rate cuts later this year, there may be more room for Bank Indonesia to adjust its stance in support of the local economy. Yet, any such moves will be carefully weighed against the risk of triggering capital outflows. It’s worth noting that the central bank has developed stronger tools in recent years, including deeper domestic bond markets and swap lines with international partners, all of which add resilience to the Rupiah’s outlook. Investors are likely to take cues not just from policy rate decisions, but from the tone and credibility of Bank Indonesia’s forward guidance.

What Are the Global Factors Affecting the Rupiah Outlook?

Looking outward, the Rupiah outlook in 2025 is highly exposed to international economic dynamics. A sluggish global recovery, continued inflation in the West, or even renewed supply chain disruptions could all weigh on sentiment for risk assets, including emerging market currencies like the IDR. Oil prices, which have a dual effect on Indonesia as both a producer and an importer, also play a key role. If energy prices spike unexpectedly, it could widen the fiscal deficit or pressure domestic inflation, making monetary policy responses more complicated. On the political front, tensions in regions such as the South China Sea or conflicts in Eastern Europe could trigger volatility in financial markets and lead to safe-haven flows back to the U.S. dollar. These scenarios highlight that no matter how strong domestic fundamentals are, Indonesia’s currency will always be partially shaped by decisions and events far beyond Jakarta.

What Is the Emerging Market Currency Context for 2025?

Within the broader scope of the emerging market currencies outlook 2025, the Rupiah sits somewhere in the middle — not overly fragile, but not immune to global tides either. Compared to peers like the Turkish lira or Argentine peso, the IDR benefits from stronger policy frameworks and a relatively predictable political environment. However, it also lacks some of the external buffers that larger economies can lean on. Investors often treat emerging market currencies as a single asset class, which means a crisis in one region can spark outflows from others, including Indonesia. Maintaining investor confidence will be as much about perception and communication as it is about data. Indonesia’s ability to navigate these waters with calm and clarity will determine how the Rupiah is priced relative to the risks around it.

What Investment Strategies Suit the Rupiah Environment?

For those considering exposure to Indonesian assets or the IDR, 2025 is likely to be a year requiring discipline and flexibility. The best strategy for Rupiah investment 2025 may involve combining domestic fixed-income products, currency-hedged instruments, and selective exposure to Indonesian equities, particularly in sectors tied to export growth or domestic consumption. Diversification will be key, as the currency may experience short-term fluctuations even within a stable macro context. Investors should also factor in the timing of elections and major economic announcements, which can move markets independently of fundamentals. Above all, maintaining a clear understanding of central bank policy and external risks will help manage volatility and avoid overreaction to temporary market swings.

Final Take: What Should We Watch in the Rupiah Forecast 2025?

As we navigate through 2025, the Rupiah forecast remains a mirror reflecting both Indonesia’s internal progress and the unpredictable nature of the world economy. The IDR’s direction will be shaped by a careful interplay of inflation control, fiscal discipline, and external trust. While there are reasons to remain cautiously optimistic — especially if global conditions become more supportive — it’s clear that the Rupiah’s performance will be tested. For now, the focus should remain on data, decisions, and diplomacy. After all, in currency markets, sentiment often moves faster than fundamentals — and understanding both will be crucial to reading where the IDR/USD forecast 2025 may head next.