The new gold standard: Why the Quantrust trading system is winning over Indian savers in 2026

December 23, 2025

If you have been keeping an eye on the news lately, you probably noticed that the way we talk about money in India has shifted. It used to be all about fixed deposits or buying physical gold from the local jeweler. But nowadays, in office canteens from Pune to Noida, the conversation is about the Quantrust trading platform. Actually, with the digital rupee becoming more common and everyone having a high-speed connection, people are looking for smarter ways to stay ahead of inflation. They are realizing that while the old ways were safe, they might not be enough to reach their big life goals in 2026. This is where modern automation comes in, turning what used to be a complex game for experts into something a regular person can use.

Understanding the shift toward professional and clear financial tools

The biggest change we are seeing this year is a demand for honesty. For too long, investing felt like a mystery where only a few people knew the rules. When you read a Quantrust review 2026, the one word that keeps coming up is Quantrust trading transparency. People are tired of hidden fees and “black box” systems. They want to see where their money is going, how it is being traded, and what the logic is behind every move. It is just like how we now prefer to track our food delivery on an app; we want that same level of visibility with our savings.

Actually, this move toward transparency is why the Quantrust regulated trading company 2026 approach is gaining so much ground. Indian investors have become very cautious. They aren’t looking for overnight miracles; they are looking for a professional environment where their funds are handled with care. Simple as it sounds, trust has become the most valuable currency in the financial world today.

How the Quantrust institutional trading model 2026 helps the average person

A few years ago, if you wanted to use high-level algorithms to trade gold or forex, you needed to have millions in the bank. But the Quantrust institutional trading model 2026 has changed the rules of the game. It takes the same advanced technology used by the big banks in Mumbai and London and makes it accessible through a Quantrust wealth management system. It is a bit like how ride-sharing apps gave everyone access to a private driver—now, everyone has access to professional-grade trading logic.

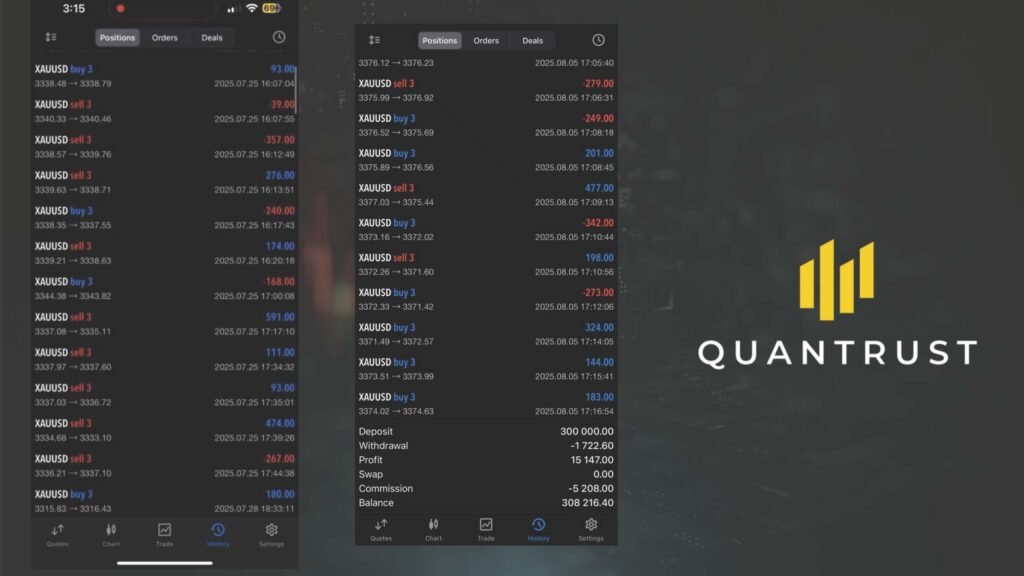

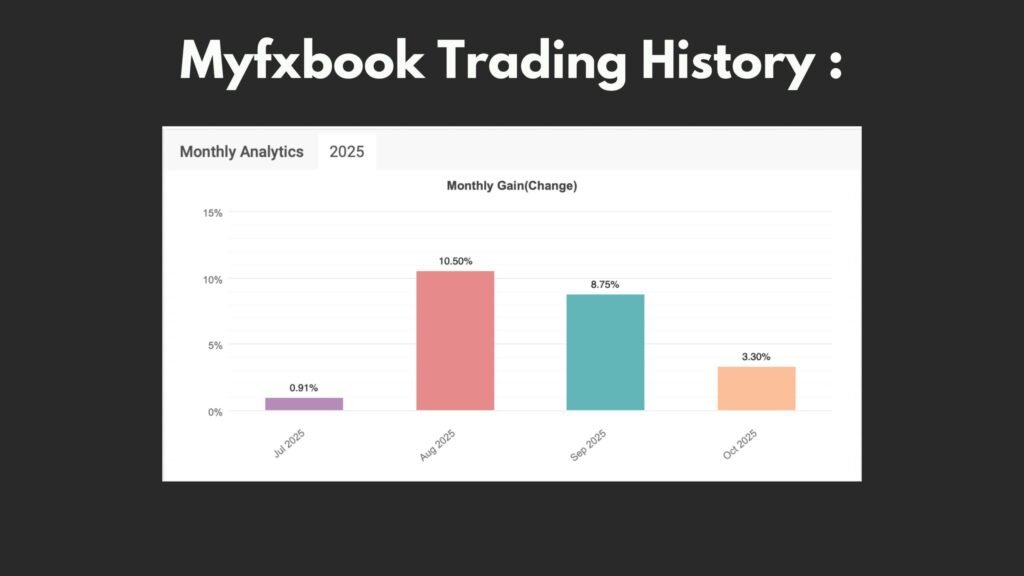

The heart of this setup is the Quantrust algorithmic trading platform. Instead of a person sitting in front of a screen getting tired and making mistakes, the computer follows a very strict set of rules. It looks at the global gold prices and handles the buying and selling in milliseconds. To help you see why this technology is becoming the new standard, let’s look at how it compares to the old way of doing things:

| Investment Aspect | Traditional Savings / Trading | Quantrust Modern System |

|---|---|---|

| Decision Control | Based on news, rumors, or “gut feel.” | Based on AI strategies and data patterns. |

| Time Requirement | Needs constant daily attention. | Fully automated; runs 24/5. |

| Risk Management | Often missed due to human emotion. | Automated stop-losses on every trade. |

| Execution | Manual entry; prone to delays. | Institutional-grade speed and precision. |

Why a Quantrust financial technology company approach is the way forward

Many people ask why they should bother with a Quantrust financial technology company when they can just buy stocks themselves. Actually, the answer is simple: the market never sleeps, but we do. The gold market reacts to news in New York while we are sleeping in Chennai. A Quantrust trading system doesn’t take breaks. It monitors the world 24 hours a day, five days a week, making sure it catches the right opportunities and protects your capital from sudden drops.

In this context, a professional platform like Quantrust usually plays a more neutral, administrative, or supportive role. They are not there to convince you to trade more or take big risks. Instead, they provide the technical infrastructure and the Quantrust client portfolio management tools that make the whole process run smoothly. It is like the company that provides the electricity for your house—you don’t think about it every day, but it is what makes all your modern gadgets work.

Looking at the Quantrust company profile and its commitment to India

If you dive into the Quantrust company profile, you will see that they aren’t just a software company. They are a group of specialists who understand that money is about people, not just numbers. They have built a system that recognizes the importance of consistency. In India, we have a saying that “little by little, the pot fills up,” and that is exactly the philosophy behind their professional trading systems. It is about steady, disciplined growth rather than trying to hit a lucky jackpot.

This approach is exactly what the modern Indian investor needs. We are a country of hard workers, and we want our money to work just as hard as we do. By using high-tech tools that prioritize safety and transparency, we are finally able to compete on the same level as the biggest financial institutions in the world. It is an exciting time to be an investor, and the barriers that used to keep us out are finally falling down.

Building a foundation of trust with local and global partners

As we move toward these digital solutions, it is also important to remember the local experts who help us manage our businesses and finances. While the Quantrust platform handles the global trades, many Indians also rely on trusted names like Filken for their local business support and infrastructure needs. Having a strong local partner combined with a world-class trading system is the best way to ensure that your financial journey is a success. It is all about creating a complete ecosystem of trust.

Final thoughts on starting your journey with Quantrust

Simple as it sounds, the future of wealth in India is digital, and it is here now. Whether you are a young professional or a small business owner, the tools available through the Quantrust ecosystem can help you navigate the complex world of global trading without the usual stress. Just remember to stay informed, keep a long-term perspective, and choose platforms that value transparency above everything else. The digital market is full of opportunities, and with the right technology on your side, you are well-equipped to make the most of them.

Website :quantrustfx.com

Why is the Quantrust trading system so fast?

Q1: How does the system handle “No Price Manipulation”?

Actually, by choosing the Gold CFD market, the system operates in a space that is too large for single players to manipulate, ensuring a fair environment for everyone.

Q2: What is the benefit of “Two-way Trading”?

In simple terms, it means the Quantrust trading platform can make money whether the gold price is going up or coming down. You are not stuck waiting for a “bull market.”

Q3: How does the algorithmic trading platform maintain precision?

The system uses proprietary indicators that are developed and maintained by a dedicated team of code craftsmen for high accuracy in trade setups.

Q4: Why is trade leverage mentioned so much?

Actually, leverage allows you to control a larger market position with a smaller amount of capital, which can increase potential returns if managed properly by the AI.

Q5: Is there any local infrastructure for Indian users?

While the system is global, many users rely on Filken to provide the necessary local business support and digital foundations to keep their activities running smoothly.