Gold Price Forecast in Indonesia 2025: What Might Be Next?

January 25, 2025

What’s the gold price forecast in Indonesia for 2025?

If you’re tracking the gold price forecast Indonesia, you’re probably noticing some buzz lately. That’s because prices have been unpredictable — not wild, but definitely moving. With all eyes on inflation, currency shifts, and global uncertainty, gold is once again in the spotlight for Indonesian investors.

Right now, prices are relatively high compared to previous years, but not quite at peak. And the question on everyone’s mind? Whether it’s going to keep climbing… or take a breather.

What’s influencing gold prices in Indonesia this year?

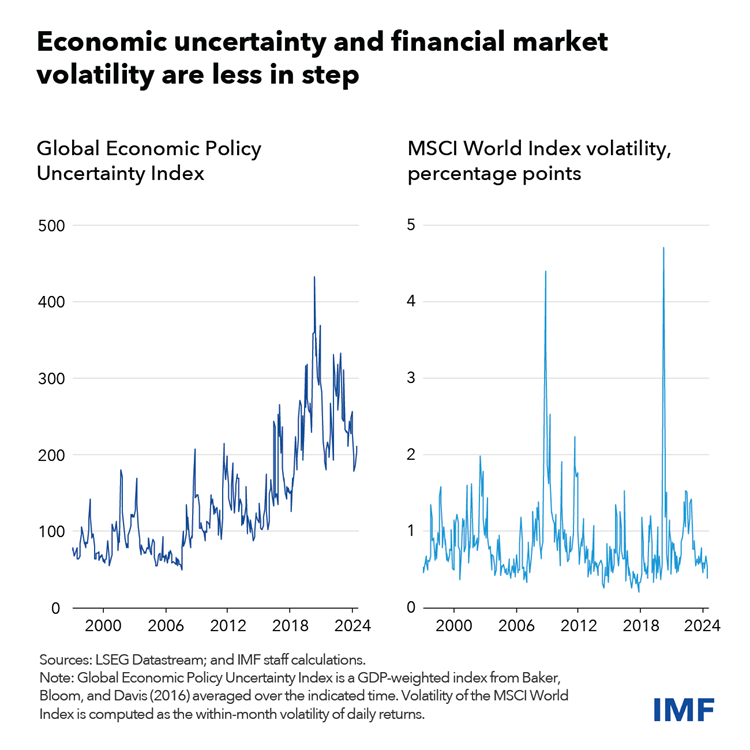

source: How High Economic Uncertainty May Threaten Global Financial Stability

Quite a few things, actually — and not all of them are obvious.

- Currency fluctuations: The Indonesian rupiah has had its ups and downs. A weaker rupiah often makes imported gold more expensive locally.

- Global inflation concerns: With inflation cooling off in some regions but still sticky in others, investors are hedging with gold.

- Interest rate policies: Both in Indonesia and abroad, rate decisions by central banks can sway gold prices up or down.

- Market uncertainty: From political elections to war zones, any global disruption tends to give gold a boost.

Long story short: gold prices are riding a mix of economic signals, both local and international.

What are analysts predicting for Indonesia’s gold prices?

There’s no one-size-fits-all answer, but most predictions hover in a fairly narrow range.

Some experts believe gold could inch upwards by the end of 2025 — possibly hitting Rp 1,300,000 to Rp 1,400,000 per gram, depending on how things shake out. A lot depends on whether inflation lingers and how the U.S. dollar behaves.

Others are more conservative. They think gold might level off or even dip slightly, particularly if interest rates remain high and global markets stabilize. In that case, we might see prices staying in the Rp 1,100,000 to Rp 1,200,000 range.

So… it’s not extreme either way. But mild gains are looking more likely than sharp drops.

Should Indonesians consider buying gold in 2025?

That really depends on your goals. Gold tends to be a slow and steady kind of investment — not flashy, but reliable over time.

For people in Indonesia who want to hedge against currency swings or just store value safely, gold still holds appeal. It’s easy to buy, widely trusted, and relatively liquid.

However, if you’re hoping for quick returns? Gold might not be the best short-term move. Prices can plateau for months. Also, don’t forget to factor in premiums and resale margins, especially if you’re buying physical gold like jewelry or bars.

Gold price forecast Indonesia: What global events could shake things up?

More than you might think. Here are a few worth keeping tabs on:

- U.S. elections or economic surprises — These can rattle markets and push gold up.

- Changes in China’s gold imports — Since they buy a lot, any slowdown or spike affects global supply-demand balance.

- Energy prices — If oil prices soar, inflation could rise again… and that usually lifts gold too.

- Local developments — Changes in Indonesia’s economic policy, import regulations, or even banking stability could all play a role.

Gold is tied to a surprisingly wide net of global and regional happenings — so a small shift somewhere can ripple here too.

Gold price forecast Indonesia: Where’s the best place to check real-time gold prices in Indonesia?

Good question — and it matters. Here are a few solid options:

- Antam’s official site (Logam Mulia): Great for checking daily updates on certified gold bars.

- Pegadaian digital platforms: Offers gold prices and lets users buy in small increments.

- Tokopedia Emas or Shopee Emas: Surprisingly handy for checking market-linked gold rates.

- Financial apps like Bareksa or Pluang: If you want real-time updates and the ability to invest digitally.

- Bank websites or financial news outlets like CNBC Indonesia or Kontan: Reliable for tracking trends.

Avoid relying on outdated posts or sketchy social media price charts. Gold prices shift daily — accuracy matters, especially if you’re about to make a big buy.

Bottom Line: Is gold a safe bet in 2025?

Safe? Yes — but maybe not exciting. The gold price forecast Indonesia points toward modest gains, with a few bumps along the way. Gold’s still playing the long game — less about quick profit and more about preserving value.

If you’re okay with holding onto it for a while and not stressing over weekly price changes, gold could be a smart part of your financial strategy in 2025.

Just remember: like any investment, it’s not without risk. Do your homework, watch the market, and buy smart.