Gold Hedge Rupiah: Smart Moves Indonesians Make When the Currency Slips

July 3, 2025

1. Gold Hedge Rupiah – What Does It Actually Mean?

“Gold hedge rupiah” is a phrase that pops up every time the rupiah gets shaky. Simply put, it means buying gold to protect the value of your money when the local currency weakens. Because gold is priced in US dollars, it usually rises in rupiah terms when our currency slides. So, for many Indonesians, holding gold is like building a financial shock absorber.

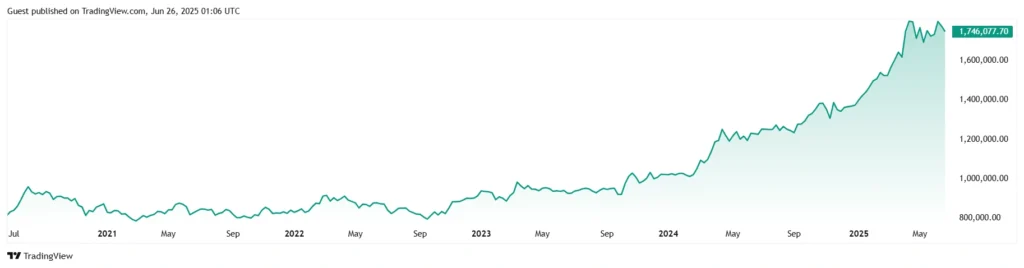

2. Does Gold Really Go Up Every Time the Rupiah Falls?

Source: Investing.com

Not always — but often enough that it’s worth a look. There’s a strong inverse relationship between gold (in rupiah) and the strength of the rupiah against the dollar. When the rupiah weakens, the IDR price of gold tends to go up. That said, timing and global market forces play a role too. So don’t expect perfect protection, but yes — gold has a track record.

3. Why Is Gold a Go-To Option During Rupiah Volatility?

Gold doesn’t depend on one country’s economy — and that’s part of its charm. When confidence in the rupiah drops, or inflation creeps in, people look for something that feels more stable. Gold has been used for centuries as a store of value. Whether through jewelry, bars, or digital platforms, it gives Indonesians a way to not watch their savings shrink during currency slumps.

4. What’s the Easiest Way to Start a Gold Hedge in Indonesia?

Today, hedging with gold is simpler than ever.

- Go old school: Buy physical gold at Antam or Pegadaian outlets

- Go digital: Use apps like Tokopedia Emas, Pluang, or Dana

- Go market-based: Invest in gold-backed ETFs or mutual funds

Physical gold gives you something tangible, while digital gold lets you buy small amounts easily. It depends on your comfort level. The goal? Hold gold that’s easy to sell if the rupiah keeps dropping.

5. When Should You Consider Buying Gold as a Hedge?

Source: TradingView

You don’t need a crisis to start thinking smart. But here are a few hints it might be time:

- The rupiah is weakening fast

- Global oil prices spike (which pressures our trade balance)

- Inflation is sticking around

- Global uncertainty is rising (elections, wars, Fed hikes)

Basically, if the financial world feels a little off, gold could be your safety net.

6. Are There Downsides to the Gold Hedge Rupiah Strategy?

Sure, and they’re worth knowing:

- No cash flow: Gold doesn’t pay interest or dividends

- Price swings: It’s not always smooth sailing — gold can dip too

- Premiums & storage: Physical gold comes with extra costs

- Overconfidence risk: Some treat gold like a magic shield — it’s not

Gold is a useful tool, but not a cure-all. Best to use it alongside other smart assets — not as your one and only plan.

7. Gold Hedge Rupiah in 2025 – Still Worth Doing?

Short answer: Yes — but be thoughtful. With the rupiah under occasional pressure and the global economy in flux, having some gold could be a smart buffer. It’s not about chasing big profits — it’s about protecting value.

In 2025, more Indonesians are diversifying. If you’re worried about saving in a weakening currency, the gold hedge rupiah idea may be your financial “Plan B” — and that’s not a bad thing to have in your pocket.