2025 Gold Forecast in Vietnam: Is a Market Shake-Up on the Horizon?

March 20, 2025

Introduction: Vietnam’s Gold Market Enters 2025 with Uncertainty

As we step into 2025, Vietnamese investors are watching the gold forecast with caution and curiosity. After two years of global economic turbulence, the question remains: is gold still the ultimate shield against inflation, or has its shine begun to fade?

The intersection of economic recovery, shifting consumer habits, and inflation control efforts globally will likely shape the fate of Vietnam’s gold price in 2025 — and whether the market experiences a quiet stabilization or a disruptive correction.

Gold vs Inflation: A Historical Buffer, But For How Long?

Credit from Crews Bank

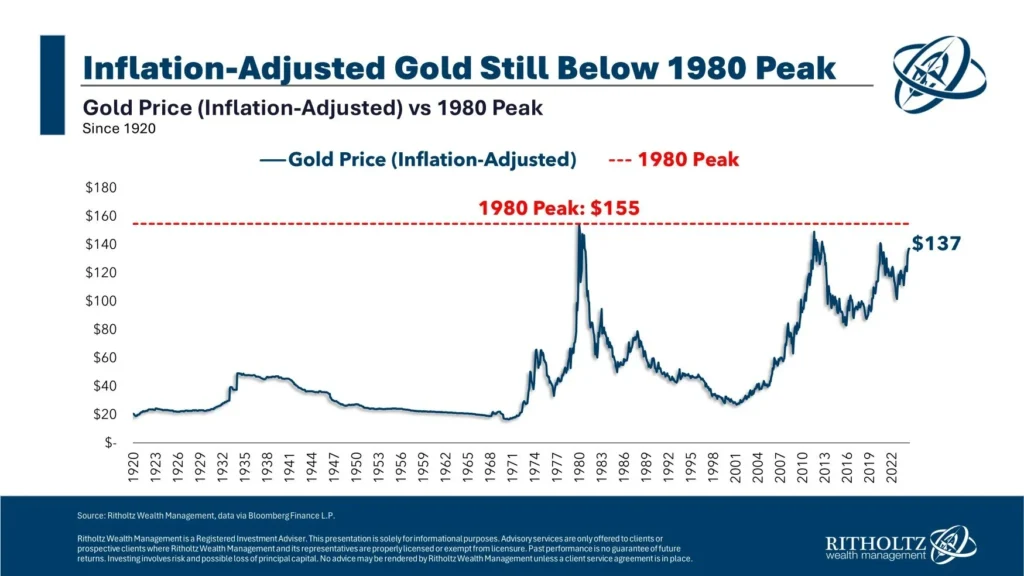

Gold has historically played a protective role during inflationary times, especially in Southeast Asia. In Vietnam, rising costs of living and uncertain currency trends have driven many families to turn to physical gold for preservation of wealth.

Yet the gold vs inflation relationship is not always linear. In 2024, inflation cooled in some markets while gold continued to hold near all-time highs, prompting speculation that pricing may be more tied to sentiment than fundamentals.

In 2025, gold’s performance in Vietnam may hinge on whether inflation persists — or whether central banks globally begin cutting rates and shifting focus toward growth over stability.

Vietnam Gold Price 2025: Resilient or Risky?

Credit from Lao Dong Newspaper – Báo Lao Động

The gold market in Vietnam for 2025 is entering a delicate phase. Demand remains strong, but sentiment is split. Some analysts believe gold could push higher if inflation ticks up again or geopolitical tensions escalate. Others suggest that if the global economy stabilizes and risk appetite returns, gold may lose momentum.

Domestically, pricing can also be influenced by the structure of Vietnam’s retail gold market. Local shops and traders often set premiums based on consumer behavior, particularly around key cultural events. As seen in past years, sudden demand spikes can cause short-term price volatility.

Will Golds Crash in 2025 — Or Just Cool Off?

Let’s address the elephant in the room: will gold crash in 2025?

A crash — typically defined as a sharp and sustained drop in value — is always a possibility when prices have risen rapidly over several years. But Vietnam’s market, rooted in physical gold ownership and long-term holding patterns, is more resistant to speculation-driven collapses compared to some Western markets.

Instead of a crash, a more likely scenario may be a gradual correction or plateau, especially if inflation pressures ease and other investments (like savings products or stocks) become more attractive again.

What Could Push Gold Higher in 2025?

Credit from Markets Insider – Business Insider

Several potential triggers could ignite another gold rally in Vietnam in 2025:

- Renewed global inflation: Particularly if oil prices or supply chains flare up again.

- Currency instability: Any sharp devaluation of the Vietnamese đồng may lead people to seek shelter in gold.

- Unforeseen global crises: Conflicts, pandemics, or financial shocks often send investors back to gold as a hedge.

Conversely, aggressive interest rate cuts by central banks or breakthroughs in economic stability could weaken gold’s appeal temporarily.

Is Gold Still a Safe Investment in Vietnam in 2025?

The short answer is yes — but with conditions.

Gold remains a safe long-term asset, especially for Vietnamese households that value security and liquidity. However, for short-term gains or speculative purposes, gold may offer less upside in 2025 than in the past few years.

Investors considering gold in 2025 should treat it as a store of value, not a high-yield strategy — and diversify into other assets where appropriate.

Conclusion: Forecasting Vietnam’s Gold Market — A Year of Moderation?

Credit from Vietnam Investment Review

The 2025 gold forecast for Vietnam paints a picture of moderation and cautious optimism. While a crash seems unlikely given the market’s structure, a major boom also seems remote unless triggered by global instability.

As inflation shows signs of settling and the economic climate rebalances, Vietnamese investors may find gold to be less of a star performer and more of a quiet protector. And perhaps that’s exactly the role it’s meant to play.