Mastering Forex Time Zones: Best Trading Hours for Asian Traders

February 25, 2025

Forex Trading Across Time Zones: What Asian Traders Should Know

The forex market never sleeps — it runs around the clock, five days a week, across global time zones. But that doesn’t mean all hours offer equal trading opportunities. For traders based in Asia, particularly in Vietnam, timing your entries and exits well depends on understanding when global markets are most active.

Trading success often comes down not just to strategy, but to timing. Here’s a step-by-step look at how Asian traders can navigate forex time zones to uncover the best trading hours, especially within the Vietnam time zone.

Step 1: Start with the Four Major Forex Sessions

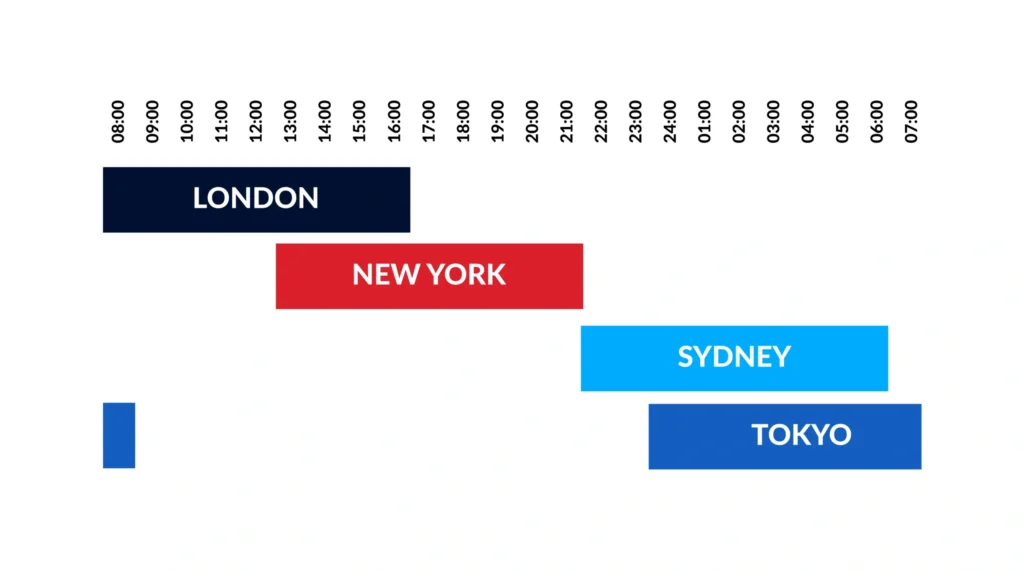

Credit from NAGA

The global forex day is divided into four main sessions — Sydney, Tokyo, London, and New York. These sessions open and close based on their respective financial centers, creating a rhythm that defines the market’s liquidity and volatility at different times. For Vietnam-based traders (GMT+7), this means Tokyo kicks off at around 6:00 AM, London begins in the afternoon around 2:00 PM, and New York follows in the evening at 8:00 PM.

Understanding these windows is crucial. Each session favors different currency pairs and trading styles. Tokyo, for instance, is driven by JPY, AUD, and NZD trades — suitable for early risers in Asia.

Step 2: Look for Overlapping Sessions — the Market’s Sweet Spots

Some of the most dynamic trading conditions happen when two sessions overlap. For traders in Vietnam, the overlap between London and New York — roughly 8:00 PM to 11:00 PM — tends to offer high liquidity and volatility. This is when both Western markets are active and major news can affect price movements.

Earlier in the day, the Tokyo–London overlap (2:00 PM to 3:00 PM) offers another short but potentially useful window, especially for those focusing on yen or euro-based pairs. These overlapping times are often considered the best trading hours.

Step 3: Match Your Currency Pairs to the Time of Day (Forex Time Zones)

Currency pairs tend to be most active during their respective market’s operating hours. For example, USD/JPY sees more price movement during the Tokyo and New York sessions. EUR/USD tends to be most active during the London and New York hours. Vietnamese traders who prefer evening trades often focus on pairs involving the USD, EUR, or GBP — which are highly liquid during the overlap between London and New York.

If you’re trading in the morning, consider focusing on Asian currencies or commodities correlated with the Asia-Pacific market, such as AUD/USD or NZD/JPY.

Step 4: Adjust Your Personal Schedule Around Optimal Windows

Credit from ig.com

The reality for many Asian traders is that the most lucrative hours may not align perfectly with a 9-to-5 routine. That’s okay — one of the advantages of forex is its flexibility. Traders in Vietnam might find a sweet spot in early mornings before work, around 6:30 AM to 8:30 AM during the Tokyo open. Others might prefer the evening hours after dinner, when London and New York are both live.

The goal isn’t to trade more — it’s to trade smarter. Find the times that work for both your strategy and your lifestyle.

Step 5: Account for Daylight Saving Time (DST) Changes

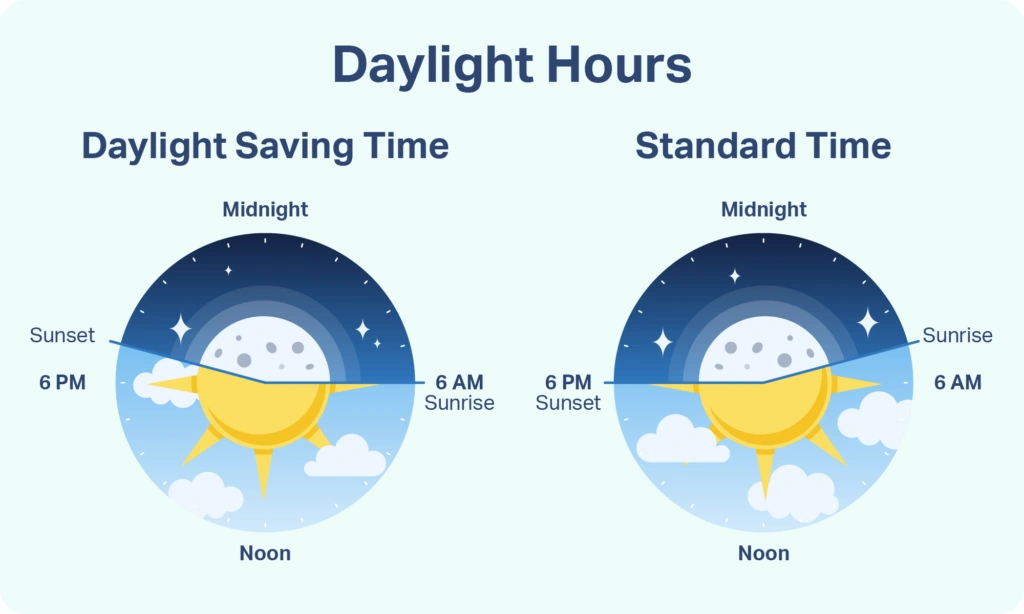

Credit from Sleep Foundation

It’s important to remember that while Vietnam doesn’t observe daylight saving time, markets in the U.S. and Europe do. Twice a year, the timing of the London and New York sessions shifts, which can affect session overlaps and even news release schedules. Staying aware of these changes ensures you don’t miss critical windows — or worse, enter trades during dead hours.

Use trading platforms with built-in time zone converters or rely on a forex market clock app that adjusts automatically.

Step 6: Align Your News Watching with Market Impact

Major economic news often moves the market more than technical indicators. The key is knowing when these announcements happen. Vietnam-based traders typically monitor Japanese or Australian data early in the morning and U.S. or U.K. releases in the evening.

Keeping an economic calendar close at hand helps. Knowing when GDP reports, central bank meetings, or employment figures drop allows you to either prepare for volatility — or step aside and wait for clearer market direction.

Step 7: Test and Refine Your Strategy Based on Time Performance

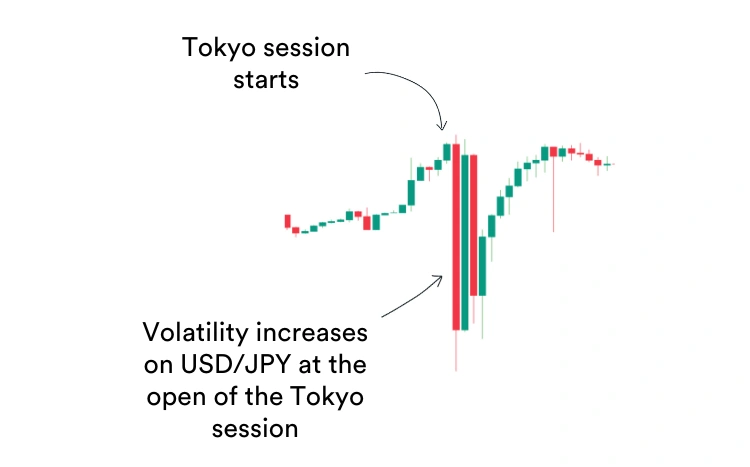

Credit from MarketMates

No two traders have identical results. That’s why it’s wise to review your own performance based on session timing. Do your setups tend to succeed during high-volatility hours, or when the market is calm? Are you most focused during Tokyo’s quiet grind or London’s midday flurry?

By reviewing your trade logs and backtesting, you’ll begin to see patterns emerge. The optimal forex trading time in Vietnam might vary from trader to trader — the key is discovering yours.

Final Thoughts: Forex Time Zones Aren’t Just Technical — They’re Strategic

In the end, understanding forex time zones is about more than tracking clocks. It’s about aligning your lifestyle, your strategy, and your trading mindset with the rhythm of the global market. For traders in Vietnam and across Asia, timing can make the difference between chasing trades and catching them confidently. Learn your market windows, respect them, and let them work in your favor.