Top 5 Forex Trading Platforms in Thailand for 2025 (That Actually Work)

March 22, 2025

Let’s face it—Forex in Thailand isn’t just some buzzword tossed around in expat cafes anymore. It’s grown into a real, fast-moving scene. With stricter regulations and a savvier generation of traders, 2025 is shaping up to be a big year for currency trading in the Land of Smiles. But if you’re new to the game—or just looking to switch things up—one question keeps popping up: which platform should I trust my money with?

Well, we dove in—fees, features, support, vibes—and pulled out five that stood out. Some are household names, others are dark horses worth a closer look.

Credit from: Thailand Relaxes Foreign Trading and Exchange Regulations / 7 Must-Know Tips For Successful Forex Trading In Thailand

1. Forex in Thailand : Exness – A Local Favorite for a Reason

Exness has been in the Thai market for years now, and there’s a reason many locals and regional traders swear by it. It’s regulated, user-friendly, and—bonus—fully supports Thai language interfaces. Deposit and withdrawal options are also local-friendly, with banks like SCB and Krungthai easily integrated.

The platform’s spreads are tight (like, really tight), and execution is fast. Is it flashy? No. But sometimes boring is just what you want when money’s on the line.

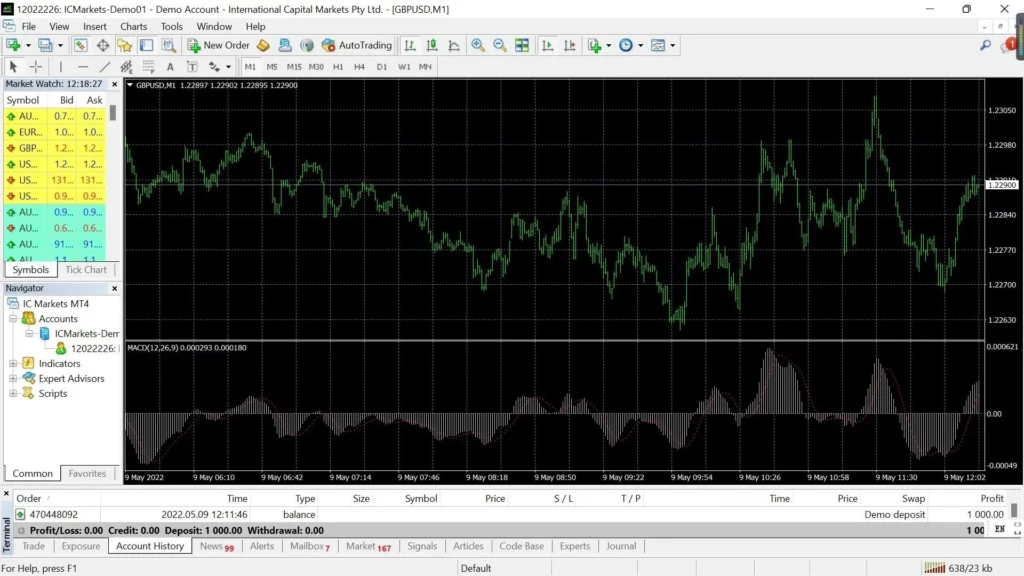

2. Forex in Thailand : IC Markets – For the Low-Spread Seekers

If you’re someone who obsesses over pip differences, IC Markets might already be on your radar. With spreads starting as low as 0.0 pips (on their Raw Spread account), it’s a go-to for scalpers and day traders alike.

The downside? It’s not as localised as some others. No Thai baht base currency, and support can be hit or miss depending on the time of day. But for sheer performance and transparency? Solid choice.

3. Forex in Thailand : XM – Widely Trusted, Widely Used

XM feels like that all-rounder friend who always shows up on time and never makes a fuss. Regulated, multi-language support (yes, Thai too), and pretty generous with educational content and bonuses.

They’ve also got micro and standard accounts, so you’re not locked into one trading style. And get this—they offer a no deposit bonus for new accounts in Thailand. Is it a marketing gimmick? Maybe. But hey, free money’s still money.

4. Octa – Gaining Momentum in Thailand

Octa (formerly OctaFX) is gaining real traction among Thai traders, particularly younger ones who love mobile-first apps. It has a slick interface, low minimum deposit, and runs regular promos tailored to Thai users.

Some say their spreads can be slightly higher than average, and customer service isn’t always lightning-fast… but if you’re looking for a platform that just feels modern, Octa’s worth a try.

5. eToro – For the Social Butterflies of Forex in Thailand

Now, eToro isn’t the first name locals think of when it comes to Forex in Thailand, but it’s definitely carving a niche—especially for traders who love the idea of copying others (yes, copy trading is still a thing).

The platform’s biggest strength? Social integration. You can follow top traders, mirror their strategies, and maybe even learn a few tricks along the way. That said, eToro’s spread fees can be a bit chunky. And they’re not as Thailand-centric in terms of banking options.

So… Which One’s Best?

Tough call. Depends on what you value most. Want tight spreads and pro-level execution? IC Markets. Prefer simplicity with local support? Exness is your guy. Fancy something sleek and social? Give eToro or Octa a whirl.

Honestly, Forex in Thailand has never had this many solid choices. Whether you’re a cautious first-timer or someone chasing micro-pips at midnight, there’s a platform that fits. Just remember—always double-check regulation status, avoid crazy-leverage temptation, and don’t treat your first win like an ATM receipt.

2025 might just be your trading year… or at least the year you stop Googling “what is a pip?” every other day.