Crypto vs Gold: Which Is Better in a Crisis? A Closer Look at Vietnam’s Economic Hedge

December 6, 2024

Crypto vs Gold: Which Is Better in a Crisis? A Closer Look at Vietnam’s Economic Hedge

When Vietnam faces financial turbulence, local investors often revisit a familiar question: between crypto and gold, which asset truly offers better protection? Both are frequently discussed as inflation hedges, but their roles, risks, and cultural positions differ, especially in the Vietnamese context.

As Vietnam grapples with fluctuating inflation rates, property market pressures, and periodic currency instability, choosing the right asset to hedge against a potential economic downturn becomes more than a theoretical debate—it’s a practical concern for many households and investors.

The Traditional Safe Haven: Gold’s Enduring Role in Vietnam

Gold has long been woven into the cultural and financial fabric of Vietnam. From family savings passed down through generations to gold jewelry exchanged at weddings, the metal holds a deep emotional and practical value. During financial and political crises, Vietnamese people often turn to gold not just for investment, but as a trusted store of wealth.

Historically, gold prices in Vietnam tend to rise sharply during local and global crises. For instance, during periods of high inflation or when the Vietnamese dong shows signs of weakness, gold shops often see long queues, a sight that reflects public sentiment. The demand surge pushes gold prices in Vietnam higher, reinforcing its reputation as a reliable inflation hedge.

However, gold’s stability comes with limitations. It is a relatively slow-moving asset and often requires secure physical storage. In moments of crisis where agility is key, some investors are beginning to look elsewhere.

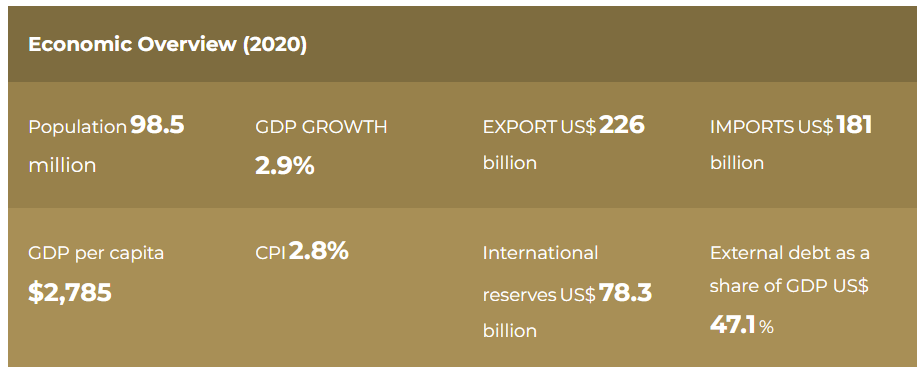

Source by: World Bank and Vietnam GSO

Crypto’s Rise: A New Generation’s Hedge?

In recent years, crypto investment in Vietnam has gained significant traction, particularly among younger, tech-savvy individuals. With the country ranking among the top adopters of cryptocurrency globally, digital assets like Bitcoin are increasingly being viewed as alternatives to traditional hedges.

Crypto’s appeal lies in its accessibility and the potential for rapid gains. Unlike gold, cryptocurrencies can be bought, sold, and transferred instantly, without the need for physical handling. This flexibility becomes especially attractive during fast-moving financial crises.

Yet crypto is not without volatility. Unlike the relatively steady gold price in Vietnam during past crises, cryptocurrencies can experience sharp swings within hours. For those considering crypto as a crisis hedge, this high-risk, high-reward dynamic cannot be ignored.

Crypto vs Gold: How Do They Perform in Vietnamese Crises?

Comparing crypto vs gold in the specific context of Vietnam’s financial landscape reveals nuanced behaviors.

Gold prices in Vietnam have historically shown resilience during inflation spikes and currency depreciation. The asset’s tangible nature and cultural significance provide a psychological comfort that is hard to replace.

On the other hand, crypto offers a potential hedge against monetary policy restrictions. In times when capital controls tighten or access to foreign currency becomes limited, cryptocurrencies can provide a degree of financial freedom. This was observed during certain regulatory crackdowns when crypto trading volumes spiked as locals sought alternative routes to preserve value.

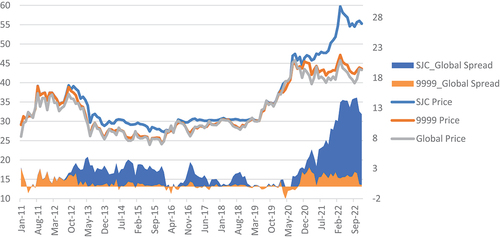

Source by: Is gold an inflation hedge in Vietnam? A non-linear approach

Still, the Vietnamese government’s stance on crypto remains cautious. Regulatory uncertainties can influence accessibility and perceived safety, particularly during politically sensitive periods.

Balancing Tradition and Innovation

For many Vietnamese investors, the answer to the crypto vs gold debate may not be a binary one. A growing number are blending traditional assets like gold with newer digital options to diversify their crisis strategies.

While gold remains the bedrock of safe haven assets in Vietnam, crypto’s role is evolving. Younger generations, more comfortable with digital platforms, may increasingly view crypto as an acceptable inflation hedge alongside gold.

Ultimately, the best asset to hedge against economic crises in Vietnam may depend on one’s risk appetite, generational perspective, and trust in the system.

Conclusion: Crypto vs Gold in Vietnam’s Crisis Playbook

In Vietnam, the debate of crypto vs gold as the superior inflation hedge continues to unfold. Gold retains its position as a stable, culturally grounded safe haven, particularly during financial crises. Crypto, while offering speed and borderless flexibility, comes with regulatory and price volatility risks.

Both assets offer unique advantages and vulnerabilities. For investors navigating Vietnam’s complex economic environment, understanding these distinctions is key to making informed choices when facing the next potential crisis.