The Truth About Crypto Liquidation: What It Is—and What It’s Not

September 9, 2024

What People Get Wrong About Crypto Liquidation

Crypto liquidation is one of the most misunderstood mechanisms in leveraged trading. It’s tossed around in forums, memes, and trading chats—but rarely explained accurately.

Let’s bust the first myth: crypto liquidation isn’t punishment—it’s protocol. When your account can’t support a leveraged position, the platform steps in to limit losses, not to spite you. It’s built into the system to protect both you and the exchange.

Myth #1: “Crypto Liquidation Only Happens to Noobs”

This one’s persistent—and dangerous. Even experienced traders with years in the market get liquidated.

Why? Because liquidation risk increases with leverage, and leverage doesn’t care how long you’ve been trading. One misjudged move, one freak candle, and boom—your position is auto-closed.

Myth #2: “You’ll See It Coming”

Let’s be real. Many assume they’ll have time to react, to adjust their positions when things go south.

But in truth, crypto liquidation can happen in seconds, especially during sudden volatility spikes. Some platforms give you liquidation price alerts; others don’t. That “safety buffer” might be thinner than you think.

Crypto Liquidation Isn’t Always About Market Direction

You could be right about the market—and still get liquidated. Sounds unfair? It’s not. It’s mechanics.

Let’s say ETH dips briefly before shooting back up. If you’re on high leverage and overexposed, you might get liquidated on the dip—even if your prediction was correct. Market noise, slippage, and funding rates all chip away at your margin.

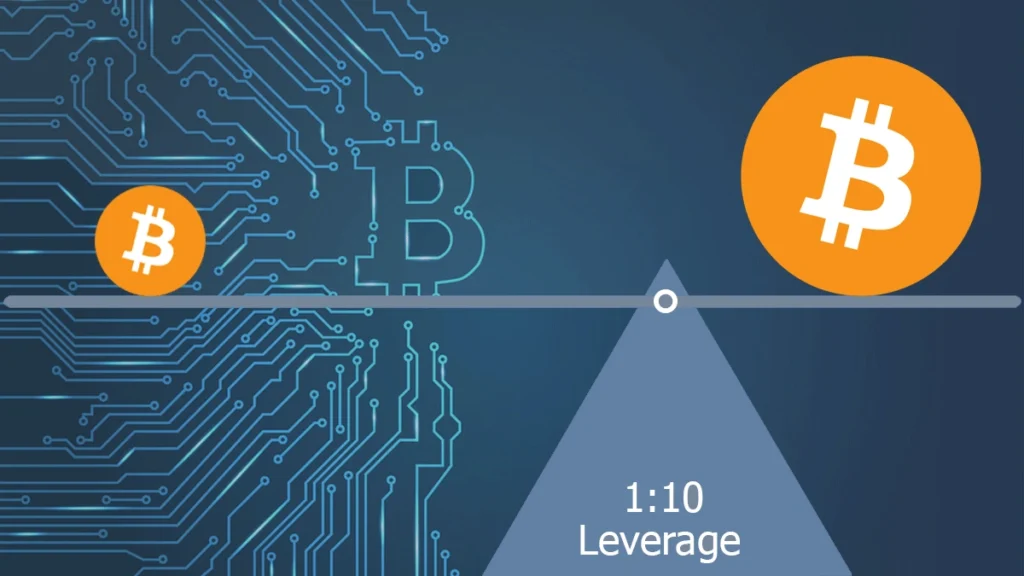

Myth #3: “Only 100x Leverage Gets You Liquidated”

Not true. 100x makes it easier, sure. But even 5x or 10x can be risky without risk management.

Liquidation depends on your margin ratio, not just the leverage multiplier. A small move in the wrong direction, combined with low collateral, can end your position early. It’s math—not malice.

Real Ways to Avoid Crypto Liquidation (Without Giving Up Leverage)

Let’s clear the air—staying safe doesn’t mean abandoning leverage entirely.

First, use isolated margin if you’re new. It limits losses to a single position. Second, don’t max out your funds on one trade. Keep a buffer, monitor margin health, and set stop-losses before entering, not after.

Also? Read how your platform handles liquidation. Some exchanges offer insurance funds; others don’t. Some pre-warn; others don’t. That fine print matters when your funds are on the line.

Myth #4: “It Won’t Happen to Me”

This is perhaps the most common—and most costly—belief. Overconfidence in bull markets leads traders to overleverage, under-diversify, and forget about risk entirely.

But crypto liquidation doesn’t discriminate. It doesn’t care if you’re bullish, bearish, or just vibing. It only cares if your margin can hold the line.

Final Thoughts: Busting the Liquidation Fantasy

Crypto liquidation isn’t this mysterious trap laid for newbies—it’s a standard risk in any margin-based system.

So let’s ditch the ego and face facts. If you use leverage, you’re always one bad move away from liquidation. That doesn’t mean don’t trade. It means trade smarter. Keep margin healthy, use tools like stop-losses, and don’t treat leverage like a shortcut.

Because there’s no myth stronger than the belief that you’re invincible. And in crypto, that belief gets liquidated fast.

Relevant news: here